tax grievance suffolk ny

333 Route 25a Ste 150. I saved thousands of dollars on my property tax bill by simply filling out the form on.

Heller Consultants Tax Grievance Home Facebook

Individual homeowners representing themselves MAY file electronically OR in hard copy.

. Our aim is to offer our clients tax. 731 rows Tax Grievance deadline of May 16 2023 applies to the following townships. If we can prove your home is worth less than that value based on sales of.

Realty Tax Challenge RTC can help you grieve your Nassau or Suffolk County property tax assessment to achieve real estate tax reductions and potentially a tax refund. Empire Tax Reductions offers tax grievance and tax relief consulting proudly serving Westchester County as well as Long Island Nassau and Suffolk Counties. Completing the grievance form Properties outside New York City and Nassau County Use Form RP-524 Complaint on Real Property Assessment to grieve your assessment.

Riverhead New York 11901. Suffolk County Property Tax Grievance Information - deadlines info links to help commercial property owners in Suffolk NY grieve their property taxes Realty Tax Challenge - 10 Hub Drive. The Suffolk County Clerks Office will not accept hard paper copy documents.

Any person who pays property taxes can grieve an assessment including. This may be done by either calling. The town of east hampton property tax grievance deadline is may 15 2018.

Your home value increases by 10000-20000 For every 1000 in lower property taxes. Tax Reduction Services Inc. Only the assessment on the current tentative assessment roll can be grieved - you cant grieve assessments from prior years.

The tax grievance deadline is always the third Tuesday in May in Suffolk County. Tenants who are required to pay property taxes pursuant to a lease or written agreement. In order for us to file on your behalf to correct your property tax assessment and reduce your taxes all.

The amount of property taxes you are forced to pay cant increase if you file a property tax grievance. Nassau and Suffolk County homeowners like you are feeling the pain of high property and school taxes. We research your case file all required paperwork and if necessary represent you in court.

Your property taxes can only be reduced It is against NYS law to raise them due to a tax grievance filing. We are a local company specializing in suffolk county property tax grievances. Friendly quick and efficient service.

The assessment grievance filing period for all suffolk county towns begins on may 1 2018 and ends on may 15 2018 the third tuesday in may. How often can I file a tax grievance. Simply apply below to have us correct your 2022 assessment.

TRS reduces real estate taxes for residential and commercial property owners who live in Nassau and Suffolk Counties and has saved Long. You may have filed for STAR or other exemptions but you may still be paying more than. Rocky Point NY 11778.

A Property Tax Grievance is a complaint filed against a towns assessed value on a particular parcel of property. Suffolk County Property Tax Grievance Bohemia NY Submit a Property Tax Grievance Form for Suffolk County DESIGNATION OF REPRESENTATIVE AND AUTHORIZATION I hereby retain. The deadline for filing property tax grievances in Suffolk County will be.

Begining March 13 2020 there will be only limited. All Island Tax Grievance specializes in representing homeowners in Suffolk County. NO REDUCTIONNO FEE We fight for every last dollar.

Information About Empire Tax Reductions Property Tax Reduction for Suffolk County Long Island NY. What You Need to Know About Grieving Your Suffolk County Taxes. WHY SHOULD YOU FILE A TAX.

In most towns on the east end you can file a grievance every year.

The Tax Grievance Process And How It Works Property Tax Grievance Heller Consultants Tax Grievance

Guide To Reduce Property Taxes In Suffolk County Final Notice Property Tax Grievance Heller Consultants Tax Grievance

Heller Consultants Tax Grievance Home Facebook

Heller Consultants Tax Grievance Home Facebook

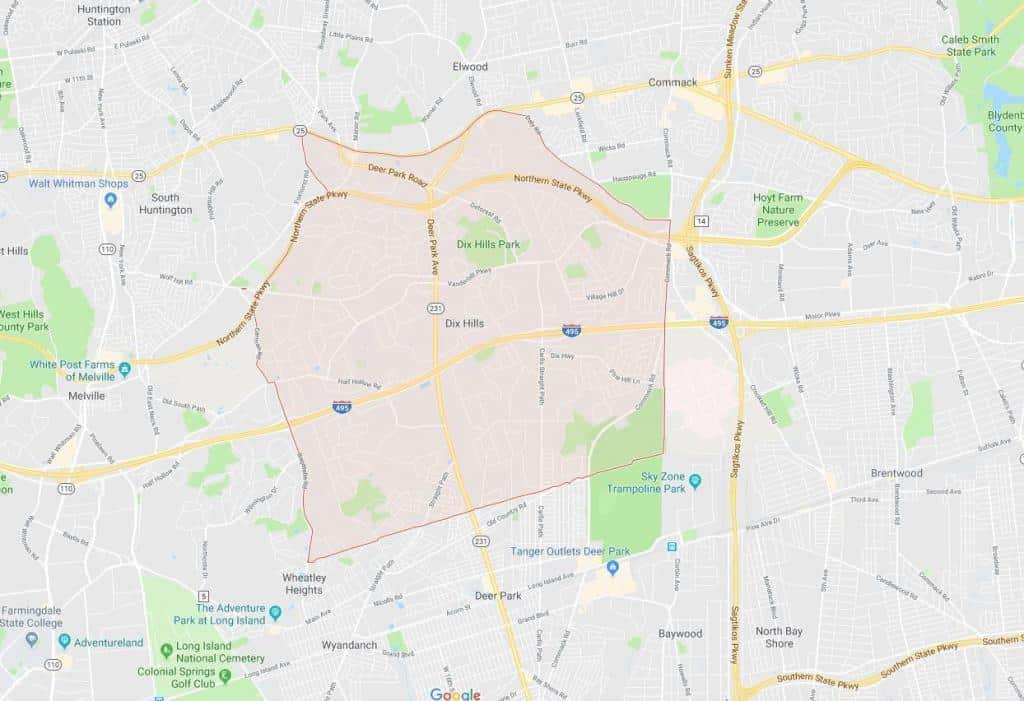

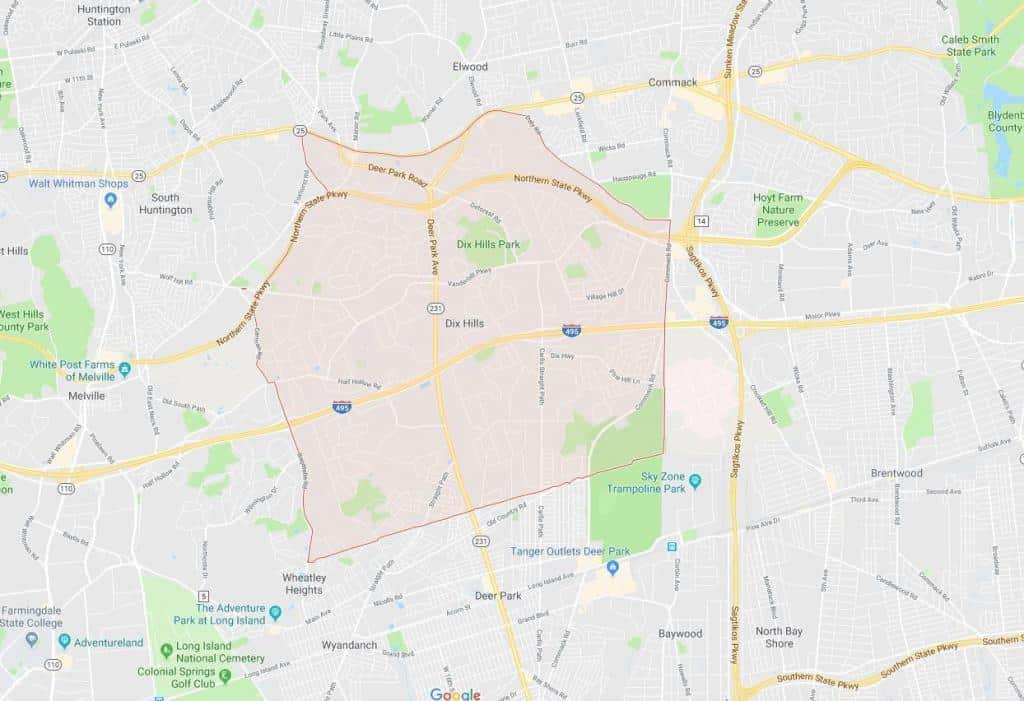

Dix Hills Property Tax Grievance Tax Grievance Company

2023 Suffolk County Property Tax Grievance Season Property Tax Grievance Heller Consultants Tax Grievance

Tax Grievance Deadline 2023 Nassau Ny Heller Consultants

5 Myths Of The Nassau County Property Tax Grievance Process

Sweet Ranch In Holstville Ny Lake Ronkonkoma Real Estate Estates

Nassau County Property Tax Reduction Tax Grievance Long Island

Nys Guide To Scheduling Your Covid 19 Vaccination

Heller Consultants Tax Grievance Home Facebook

Ny Property Tax Grievance Filing Deadlines Realty Tax Challenge

Can I Grieve My Property Taxes Every Year Property Tax Grievance Heller Consultants Tax Grievance

Nassau County Property Tax Reduction Tax Grievance Long Island